Niche VC: Part I

for alpha

I have been battling a sense of digital ADD recently, unable to sit down and read a book for more than 10 minutes without picking up my phone and doom scrolling. I have other friends who are bookish like me who have been complaining of the same.

Turns out, I just needed a damn good book as the cure. Imagine that.

Unlocking Alpha: the rise of niche VC, by Simon Lancaster with Sabrina Paseman, is a fantastic read - if you are interested in venture, that is.

They are cofounders and partners at Omni Ventures.

For the record, by the way, I do not read business books. Ever. Not since I read Peter Drucker in 1998. I usually pick one up at Barnes & Noble when I am in Pensacola, read one page, stick my finger down my throat, gag, put it back. If I wanted cheese, I would have gone to the cheese shop.

But this book flows with elegance and panache, all while managing to score data points in favour of “Niche VC” (and against mega funds, hallelujah), complete with graphs and diagrams that usually make me run for the hills but not in this case. It also takes a step back and delivers a brief overarching history of venture overall, literally the birth of venture until today - remember, after all, it’s a relatively new asset class.

The problem with venture today is that “most capital ends up chasing consensus ideas at consensus prices” according to Simon. Amen.

Venture used to be and should still be about seeing opportunities where others did not - having the courage of your own convictions and not needing the reassurance of Hipster Venture Capital (herewith HVC1).

My friend and investor I admire most in this world, Praveen Sahay, invests before others, invests when other VC found small things not to like (there’s a checklist you will find of easy ways out of deals, “clean cap table” being a fav) or invests when other less brave VC wanted to see more “traction.” And in the course of his non herd, non consensus, non HVC style of investing Praveen in the last decade has helped to create no less than 3 unicorns of out of deeptech early growth investing, often entering deals at less than $30M pre money. See Factorial to name just one.

I will continue to quote from Unlocking Alpha: the rise of niche VC all along the way, like a steady drumbeat.

When generalist firms swarm each new fad-crypto yesterday, AI infra today-niche VCs quietly excavate opportunities that nobody else realizes are gold yet2

If you exercise rigid discipline, niche focus improves your dealflow sift time and quality of analysis. It improves your ability to quickly dismiss the majority of inbound or random conference bump-ins and encounters. It’s not always easy. I myself am advising on the formation of a fund (trying to be) laser focused on maritime decarb - future fuels from ammonia and hydrogen. But then I read of my friend Fred Cassel’s investment in Lovable, which grew from 0 to $100M in ARR in 9 months reportedly and it’s quite hard not to say Holy Shit, I should be jumping on the AI bandwagon Right. Fucking. Now.

There are literally millions of investment opportunities out there. You have made the decision to focus on VC. Not PE. Not secondaries. Not property. Not crypto. Good, you have filtered out a tremendous amount of noise already.

Now do you have the courage to stay disciplined enough to stick to your thesis? If you do, then you can go deep. You can become a domain expert (if not already - I myself am a generalist who loves to hyperfocus on new themes for a period, re-emerge, find a new theme, hyperfocus, repeat). I thank my graduate school training at U.VA3. You can become an entrepreneur magnet as she immediately picks up on your market savvy within 5 minutes of engaging.

You can win deals from the generalists who have a more established brand.

Because you cured your dealflow ADD, you can spend quality due diligence time over months to get to know the entrepreneur, the technology, the immediately addressable market, maybe even attend a customer pitch or two. If in the end, you do not reach conviction, it was still a rewarding process, for you and for the team you were considering backing.

An entrepreneur never forgets her earliest backers or dignified Nos / passes.

Independent datasets keep converging on the same conclusion: Specialists are systematically beating generalists in VC. The alpha is clear.4

Norway needs more emerging fund managers, not more entrepreneurs. It’s not a chicken and egg scenario per se. Without more emerging fund managers, we simply will not lift our game to compete with the rest of the Nordics, much less Europe, must less North America.

$250M flowed in VC through Norway last year according to our venture capital association. At the same time, in Austin Texas, a city of 900,000 people, $4.5B flowed5.

In the 2024 Global Innovation Index, Sweden ranked 2nd, Norway 21st.

Norway should allocate at least $1B to create at least 20 new niche fund managers with a requirement that Norway’s anchor commitment of 50% of the first fund should be matched with private capital. And the funds should be required to invest at least 50% in Norway.

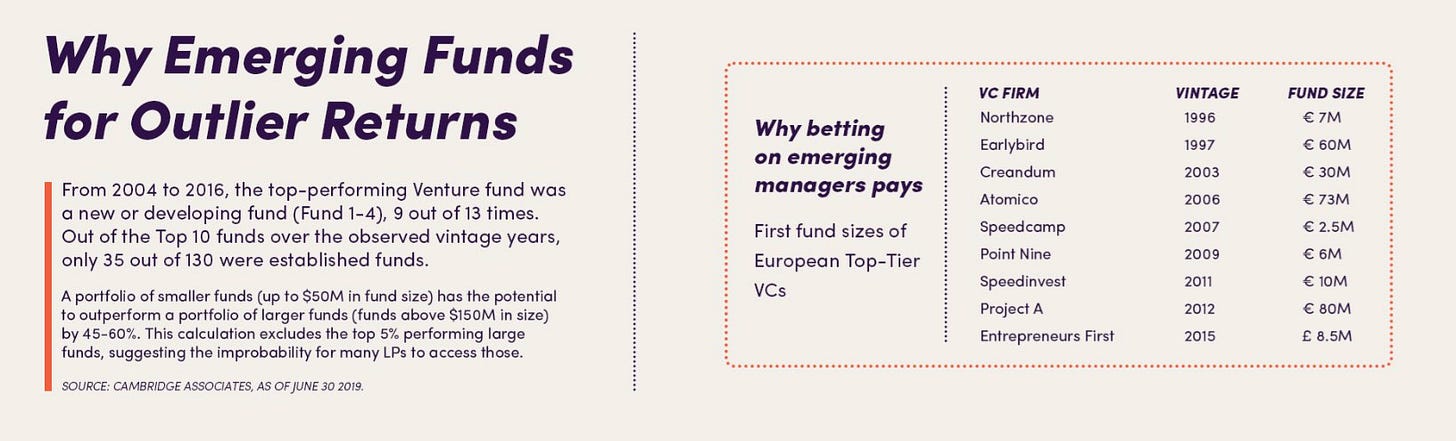

This is not charity, quite the opposite - it represents the best chance for alpha in venture (data speaking, not me) as well as to stimulate what we call the “after oil economy” of Norway. As you will see below, data from Cambridge Associates shows in a 13 year sample of fund vintages, from 2004 to 2016, the top-performing Venture fund was a new or developing fund. 9 out of 13 times.

And even more striking: A portfolio of smaller funds (up to $50M in fund size) has the potential to outperform a portfolio of larger funds by 45 - 60%.

It’s not just fund size, by the way, but fund focus that drives alpha. This is important.

The authors of my current absolute favorite business book reference a 2009 paper by Xi Han on “The Specialization Choices and Performance of Venture Capital Funds” which researched 1586 VC funds and no less than 65,168 investments. Xi quantifies fund performance via two metrics - IPO rate and acquisition rate - since IRR data is not readily available for a substantial number of firms. Her average fund size is $105M.

Interestingly, there is a negative correlation between fund size and specialisation. Tough to stay focused if you are an AUM animal at heart.

There is also a negative correlation between fund age and fund focus. I’m 50+ looking down at an alarming pot belly. At 20 you could not find a love handle if you used pliers. Discipline has waned. I like my snacks. I break my rules. Same methaphor seems to apply to fund aging. When you were “young” as a firm (even if the GPs were 47 years old at founding) you were shiny eyed and laser focused in your vertical, hungry, driven by carry, not management fees, then you grow over time, you become more confident with some wins, your AUM grows and your management fees grow, life is a bit more comfortable, and rather than doubling and tripling down on your niche, you think, I can pivot to consumer or quantum too, you use diversification as your portfolio theory justification perhaps as you think more like an “asset manager” than a VC … and returns … suffer. You may well be generating 9, 10, 11% IRR but in no way do those returns justify the risk the investors are taking, let’s be honest.

You lost alpha and found beta.

I wish I could take credit for HVC as a new acronym, but I cannot. Full credit to Captain Willie Wågen, CEO, Sustainable Energy Center.

Unlocking Alpha: the rise of niche VC, Chapter 6, page 57.

Good Ole Alan Howard of the American Studies Program. If you know, you know.

Unlocking Alpha: the rise of niche VC, Chapter 2, page 518.

A rough comparison, not precisely apples to apples datasets but the enormous gap is nevertheless a valid illustration.